Ledgers built your way

The financial source of truth you own. Twisp provides secure cloud native ledgers and payment processors that work with any partner, any bank, or standalone.

Take control

Stop fighting ledger infrastructure

We've solved the problems that keep financial system engineers up at night. Own your ledger, control your destiny.

Own your ledger

Switch banks, processors, or platforms without losing transaction history or starting over. Your ledger stays with you.

Grow with confidence

Full transactional support, snapshot isolation, and strong consistency. Designed to scale seamlessly to millions of TPS.

Build once, run anywhere

Adapt without reworking your stack. Stay ready for what’s next, wherever your business goes.

Pay for technology, not relationships

Transparent pay-per-use pricing. No minimum commitments, no relationship fees, no hidden costs.

Ship with confidence

Financial processing building blocks

Run best-in-class financial system primitives. Our processors handle the complexity of ledgers, ACH, and cards so you can focus on your product. Mix, match, and scale as needed.

The system of record

Core Ledger

The financial database you'd build if you had infinite time. Layered accounting for settlement lifecycles. Immutable history with cryptographic proofs. Interactive transactions from read-committed to serializable. Your data, your control.

- Transactions

- Interactive

- Latency

- <30ms

- History

- Immutable

- Layered Balances

- Settled, pending, and encumbered layers with available balance calculations

- Time-Travel Queries

- Query any balance or transaction as it existed at any point in time

- Cryptographic Integrity

- Hash chains and Merkle proofs ensure tamper-proof audit trails

- Tran Codes

- Programmable templates encode your business logic as reusable formulas

- Velocity Controls

- Built-in rate limits, spending caps, and compliance rules per account

- Zero-Downtime Migrations

- Add tables, indexes, and relations without taking your system offline

Stop wrestling with NACHA

ACH Processor

Turn ACH complexity into simple API calls. Handle ODFI origination, RDFI receiving, returns, and corrections across multiple banks without learning archaic file formats.

- Webhooks

- Decisioning

- Ledgering

- Automated

- Compliant

- NACHA

- Simple API

- Auto-generate NACHA files from simple API calls

- Automatic Handling

- Returns, NOCs, and corrections processed automatically

- Multi-Bank Routing

- Route transactions across multiple ODFI partners

- Real-time Updates

- Instant ledger updates, no reconciliation needed

- Flexible Processing

- Same-day, next-day, and standard ACH options

- Fraud Protection

- Built-in fraud detection and risk scoring

Authorization to settlement, simplified

Card Processor

betaHandle the full card lifecycle without the complexity. Authorization, clearing, settlement, chargebacks, and disputes with unified ledger tracking across any processor or issuing bank.

- Authorization

- Real-time

- Programs

- Flexible

- Security

- PCI DSS

- Fast Authorization

- Real-time authorization with sub-200ms response

- Auto Settlement

- Automatic clearing and settlement tracking

- Dispute Management

- Automated chargeback and dispute workflows

- Multi-Network

- Support for Visa, Mastercard, and more

- Portable History

- Switch processors without losing transaction history

- PCI Compliant

- Built-in PCI compliance and tokenization

Build anything

What will you create?

From neobanks to trading platforms, Twisp powers the financial infrastructure behind products managing billions. Whatever you're building, our ledger has you covered.

Card Processing

Real-time balance calculations for card authorization. Handle authorizations, holds, and releases with accurate ledger entries across any issuer processor.

Money Movement

Partner integrations and workflows for ACH, RTP, and wire transfers. Build custom fund flows without wrestling with payment protocol complexity.

FBO Accounts

Settlement and FBO account management with a strong internal system-of-record for tracking commingled cash balances held on behalf of customers.

Brokerage Systems

Custom positions at account level with unlimited currency balances. Layered balance tracking for complex investment products and portfolios.

Velocity Controls

Real-time materialized balance calculations for fraud controls and account limits. Apply rules across any ledger dimension instantly.

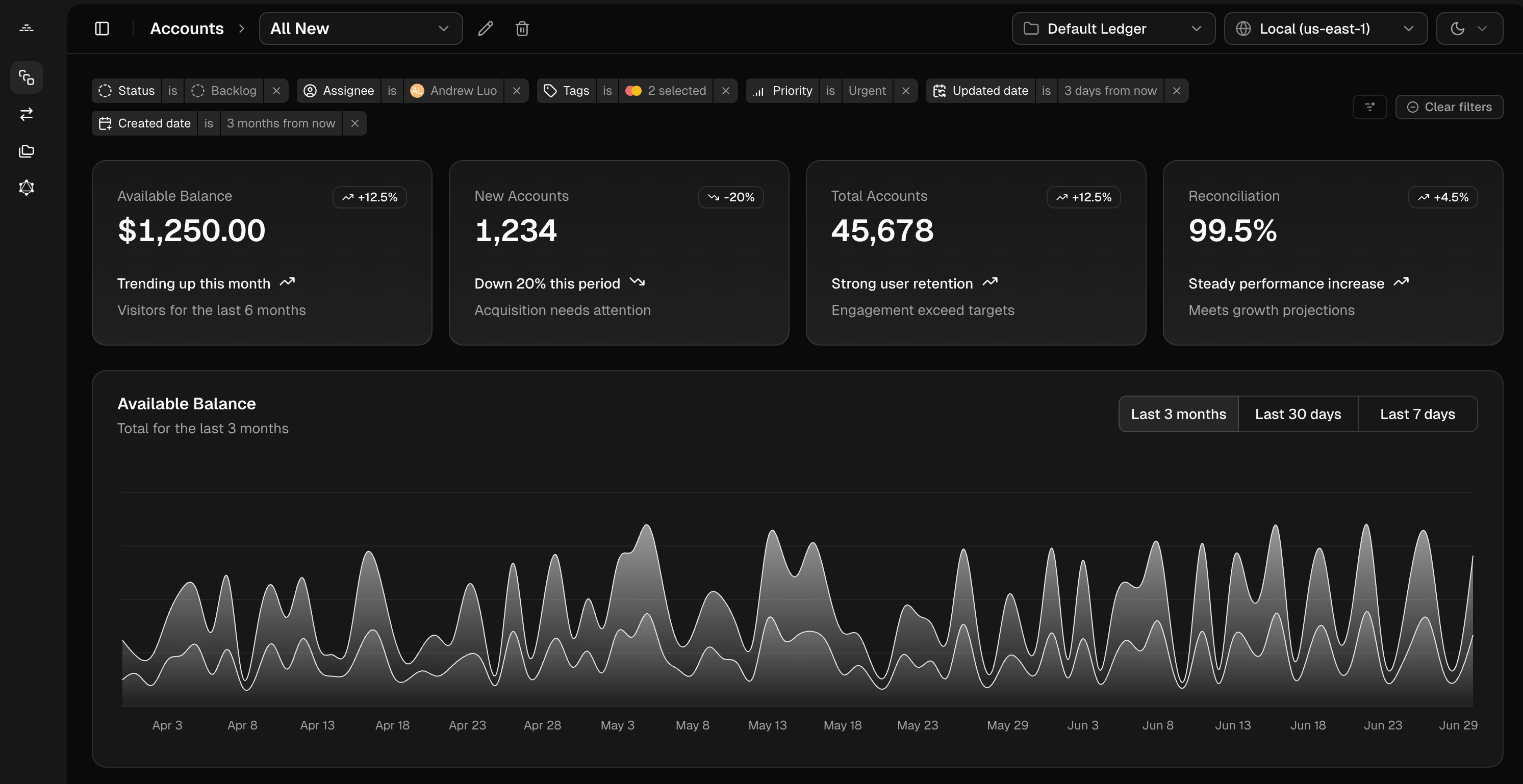

Reconciliation

Reconciliation tooling for managing exception journals with protocols for automatically reconciling transaction ordering against external systems.

Transparent pricing

Pay for processing, not relationships

No platform fees, no relationship minimums, no surprise charges. You use it, you pay for it. Period.

Cloud

- /1M Reads

- $10

- /1M Writes

- $30

- /GB

- $1.25

Pay-as-you-go with usage based pricing. No upfront commitments or minimums.

- Fine-grained security policies

- Unlimited tenants

- GraphQL and gRPC APIs

- Interactive transactions

- Administrative console

- Processors included

Dedicated

- for detailed pricing

- Contact us

Private deployment with full data and resource isolation.

- Single sign-on

- Multi-region replication

- Custom service level agreements

- Volume discounts

Support

Frequently asked questions

If you have anything else you want to ask, reach out to us.

- What card issuers do you work with?

Twisp offers direct ISO 8583 and 20022 processing capabilities. Additionally, we offer webhook adapters for most major card processing services.

- Does Twisp support regulatory examinations?

Twisp agrees to submit to examinations by appropriate federal or state regulatory authorities and provide reasonable cooperation, with required work performed at customer expense.

- What security measures does Twisp implement?

Twisp maintains an information security program with administrative, technical, and physical safeguards designed to ensure security and integrity of customer data and prevent unauthorized access.

- How is read and write usage calculated?

Transaction Read Unit (TRU): A single operation to read data from a ledger, table, or index are billed in transaction read units. One transaction read unit can read up to 4KB of data. Transaction Write Unit (TWU): A single operation to write data to a ledger, table, or index are billed in transaction write units. One transaction write unit can write up to 1KB of data.

Future-proof your financial systems

The ledger that grows with you

Deliver financial products faster with infrastructure that never limits your vision. Build once, scale forever.